Star Micronics ANNUAL REPORT 2023

STRATEGY

Medium-Term Management Plan

Star Micronics put in place a medium-term management plan in February 2022.

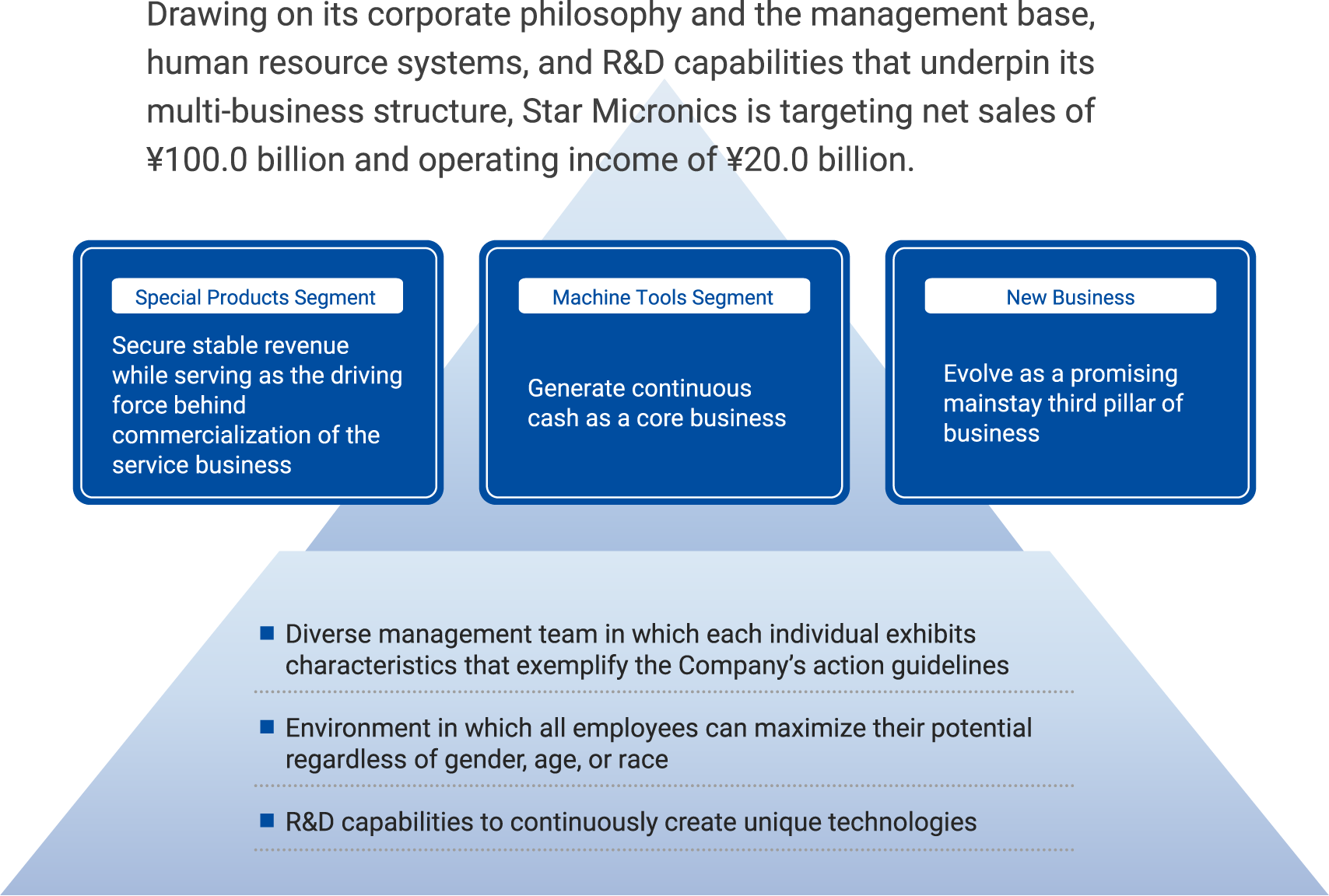

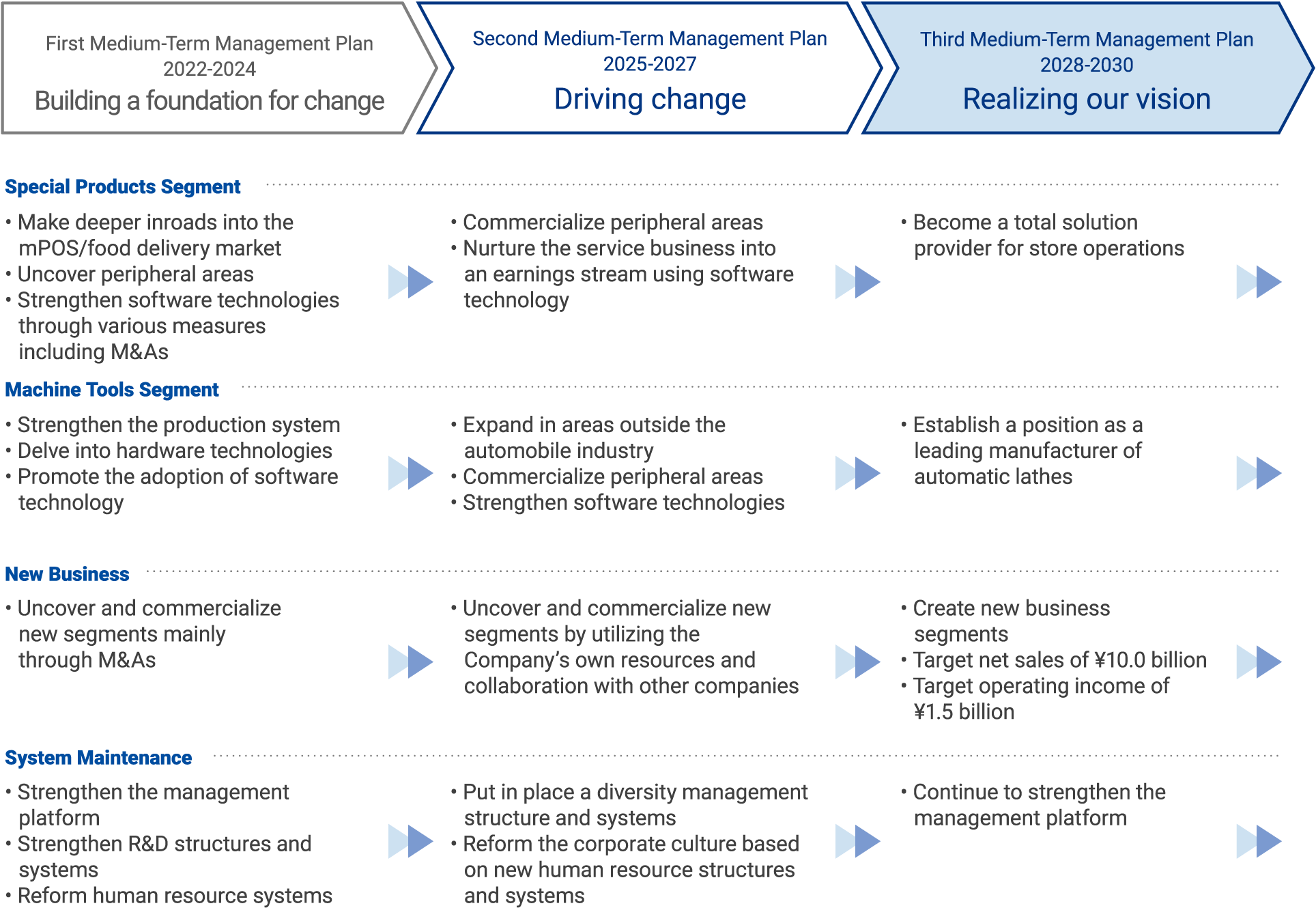

Taking stock of its Corporate Philosophy, Purpose, Management Policy, and Action Guidelines, the Company has outlined its Vision for 2030 based on the structure of this Philosophy and created a roadmap to realize this Vision.

Vision for 2030

Vision Roadmap

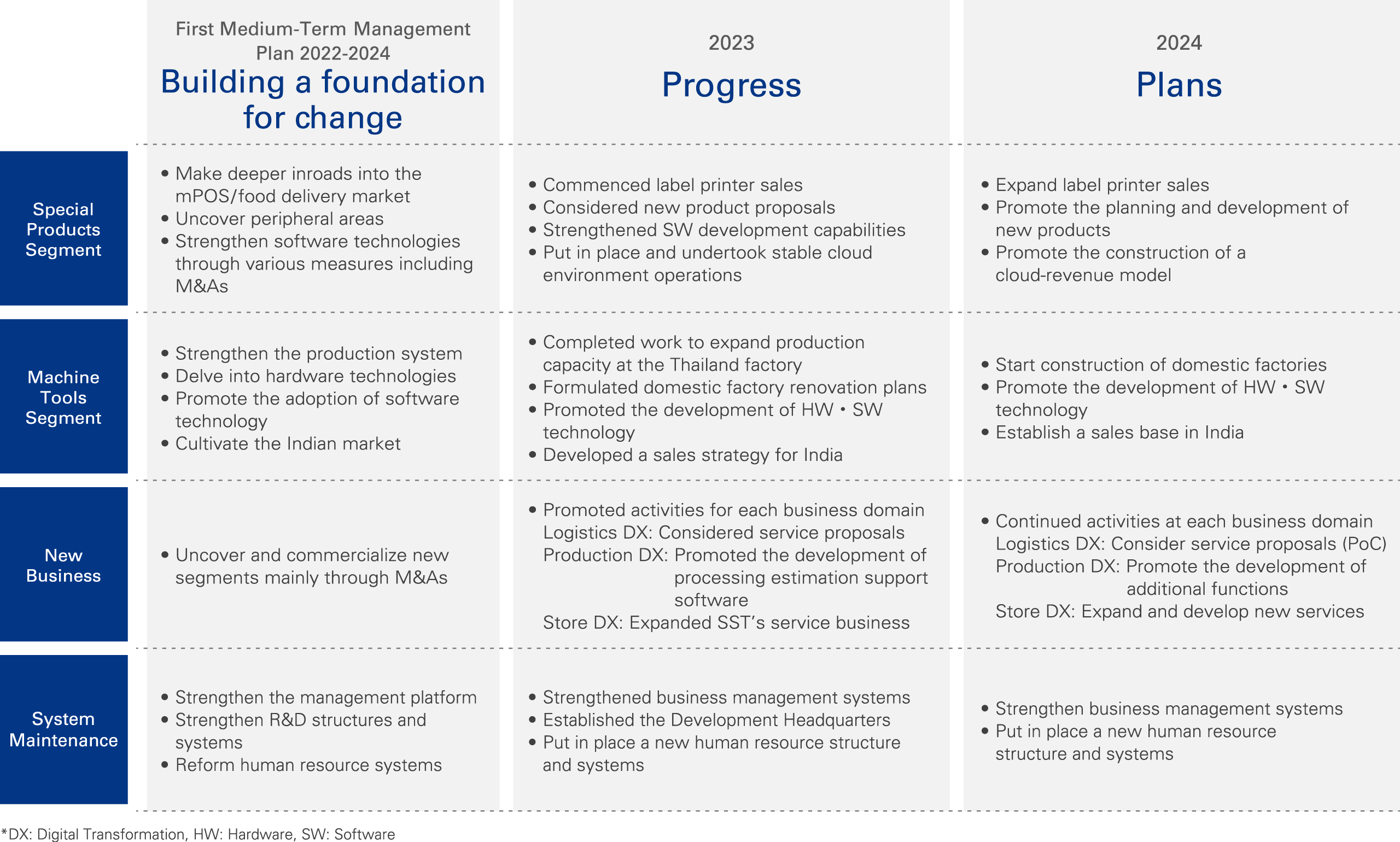

Progress of “Building a Foundation for Change”

In formulating the First Medium-Term Management Plan, Star Micronics has positioned the three years from 2022 to 2024 as a period for building a foundation for change in a bid to realize its Vision for 2030. Progress in 2023, the second year of the Medium-Term Management Plan, and plans for 2024 are presented as follows:

In addition, progress of each KPI is presented as follows:

| KPI | Target (Next three-year cumulative/average) |

2022 Actual | 2023 Actual | 2024 Forecast |

|---|---|---|---|---|

| Operating cash flow (cumulative) | ¥20.0 billion – ¥25.0 billion | ¥7.5 billion | ¥7.1 billion | ¥7.0 billion (cumulative ¥21.6 billion) |

| Operating income per employee (consolidated) | ¥6.00 million | ¥8.37 million | ¥6.19 million | ¥4.11 million (average 6.22 million) |

| ROE | 10.0% or more | 15.4% | 10.7% | 6.4% (average 10.8%) |

| Ratio of R&D expenses to net sales | 5.0% | 2.3% | 2.4% | 3.0% (average 2.5%) |

| Education and training outlays per employee (non-consolidated) |

¥100 thousand | ¥89 thousand | ¥70 thousand | ¥143 thousand (average ¥101 thousand) |

Business Strategy

[ Special Products Segment ]

First Medium-Term Management Plan 2022-2024 KPIs

| Target (Next three-year average) |

2022 Actual | 2023 Actual | 2024 Forecast | |

|---|---|---|---|---|

| ROA | 20.0% | 26.4% | 13.0% | 9.7% (average 16.4%) |

| Operating income ratio | 18.0% | 20.9% | 12.1% | 8.8% (average 13.9%) |

Principal Initiatives

- 1. Explore and expand sales of products other than printers used in stores

- 2. Strengthen cloud-related technologies with an eye to external alliances

- 3. Optimize production and logistics through reorganization of EMS partners

2023 Progress

- 1. Expanded the lineup of label printers and peripheral equipment and undertook new product planning

- 2. Undertook stable operation of Star Micronics Cloud Service (SMCS) and reinforced development capabilities

- 3. Considered the optimization of production and logistics through reorganization of EMS partners

2024 Plans

- 1. Expand sales of new products (label printers, etc.) and further promote planning; promote development with an eye toward demonstration experiments

- 2. Build a Star Micronics Cloud Service (SMCS) revenue model

- 3. Promote the optimization of production and logistics through reorganization of EMS partners

[ Machine Tools Segment ]

First Medium-Term Management Plan 2022-2024 KPIs

| Target (Next three-year average) |

2022 Actual | 2023 Actual | 2024 Forecast | |

|---|---|---|---|---|

| ROA | 15.0% | 19.6% | 15.4% | 12.0% (average 15.7%) |

| Operating income ratio | 15.0% | 17.6% | 16.7% | 15.2% (average 16.5%) |

Principal Initiatives

- 1. Globally expand the Company’s Solution Center; establish solution centers in Europe and Asia; build a user support system in collaboration with Japan

- 2. Promote the development of mechanical technology and before/after-sales service support software

- 3. Expand production capacity through three manufacturing bases

- (1) Undertake a large-scale renovation of domestic factories

- (2) Increase floor area at the Company’s Dalian factory

- (3) Upgrade and expand facilities and equipment at the Company’s factory in Thailand

- 4. Expand sales in the Indian market

2023 Progress

- 1. Started operations at the Asia Solution Center; completed design of the Europe Solution Center

- 2. Promoted the development of mechanical technology (medical application, etc.) and processing estimation support software; promoted the creation of digital content

- 3. Increased capacity by expanding production at three manufacturing bases

- (1) Undertook a large-scale renovation of domestic factories (completed the formulation of plans; started existing factory demolition work)

- (2) Completed steps to expand facilities and equipment at the Company’s factory in Thailand

- 4. Formulated a sales strategy for India

2024 Plans

- 1. Commence construction of the Europe Solution Center; coordinate with both solution centers in Japan and Asia (upgrade and expand before/after-sales services)

- 2. Commence operation of processing estimation support software and promote the development of mechanical technologies (medical application, etc.); commence providing digital content

- 3. Increase capacity by expanding production at three manufacturing bases

- (1) Commence construction the Kikugawa South Factory (core component factory)

- (2) Put in place detailed plans for the Makinohara Factory (machinery assembly factory)

- 4. Establish a sales base in India

[ New Business ]

Create new business value that contributes to improving business efficiency of customers

Principal Initiatives Develop and commercialize new business proposals mainly through the use of M&A’s

Target Consider a new services revenue model and transition to the execution phase

New Business Domains

| Business Domain | Value Provided/Business Process | 2023 Progress |

|---|---|---|

| Logistics DX | Provide systems to streamline the processes of small and medium-sized warehousing and distribution operations | Considered new service businesses and began searching for potential service partners |

| Store DX | Provide hardware and software (systems) that streamline store operations |

Included Smart Solution Technology, Inc. (SST) in the Company’s scope of consolidation as a wholly owned subsidiary; promoted PMI;

expanded sales of store DX services |

| Production DX | Provide new services related to the Machine Tools Segment | Promoted the development and internal introduction of processing estimation support software in cooperation with the Machine Tools Segment |

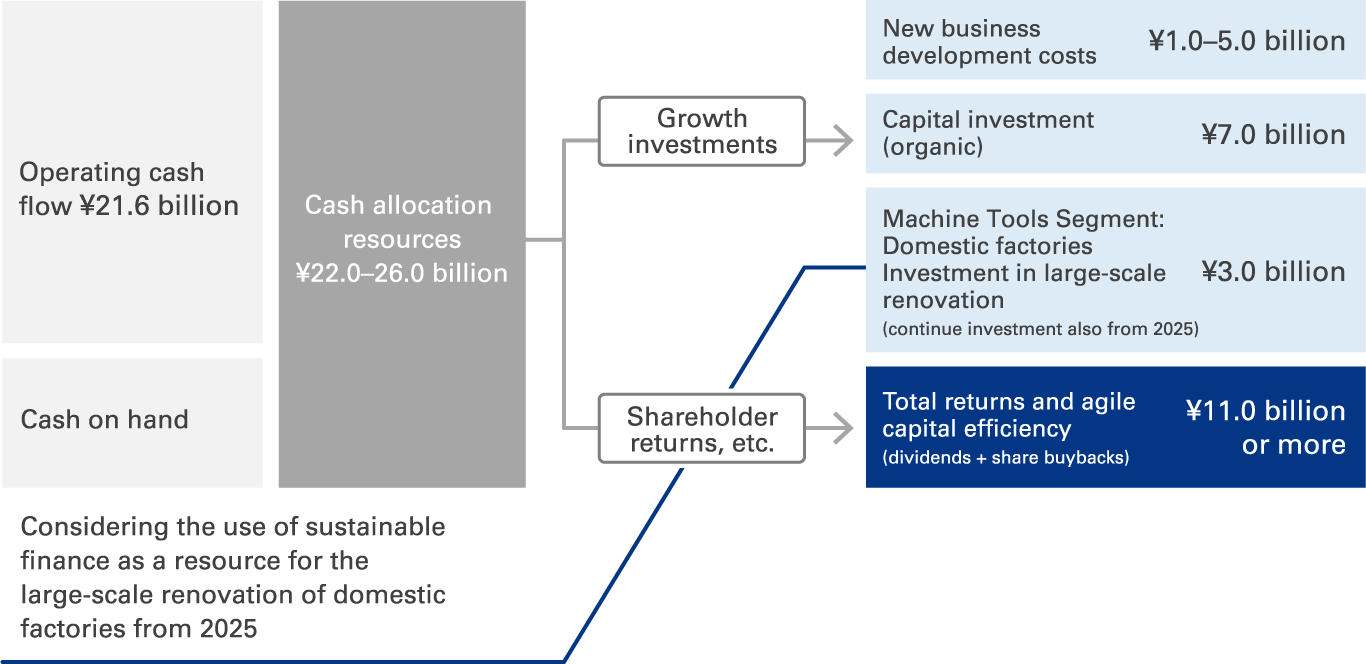

Cash Allocation

Drawing on its operating cash flow and cash on hand over the three years of the First Medium-Term Management Plan, Star Micronics will allocate ¥11 billion to growth investments as a part of efforts to carry out the aforementioned principal initiatives and ¥11 billion or more to address certain concerns including the return of profits to shareholders.

Fund Allocation Plan (2022–2024)

Star Micronics shareholder return policy is to maintain payment of a progressive and stable annual dividend of at least ¥60 per share as well as a consolidated total payout ratio of at least 50%, including the repurchase of own shares.