Star Micronics ANNUAL REPORT 2023

Review of OperationsSPECIAL PRODUCTS

Point-of-sale (POS) printers used at such places as restaurants are the main products in the Special Products Segment. In recent years, demand for mobile POS (mPOS) printers that are compatible with tablet terminals, smartphones, and other devices has been expanding. mPOS products are available under the mCollection™ brand, which not only includes printers but also such peripheral devices as cash drawers. In addition to conventional receipt applications, the product lineup includes label printers. Moreover, the Company also offers Star Micronics Cloud Services (SMCS), a cloud-based service for printers through its Special Products Segment.

In April 2023, Smart Solution Technology, Inc. (SST), a company that is active in the touch point solution business, was newly included in Star Micronics’ scope of consolidation.

Business Environment and Results in 2023

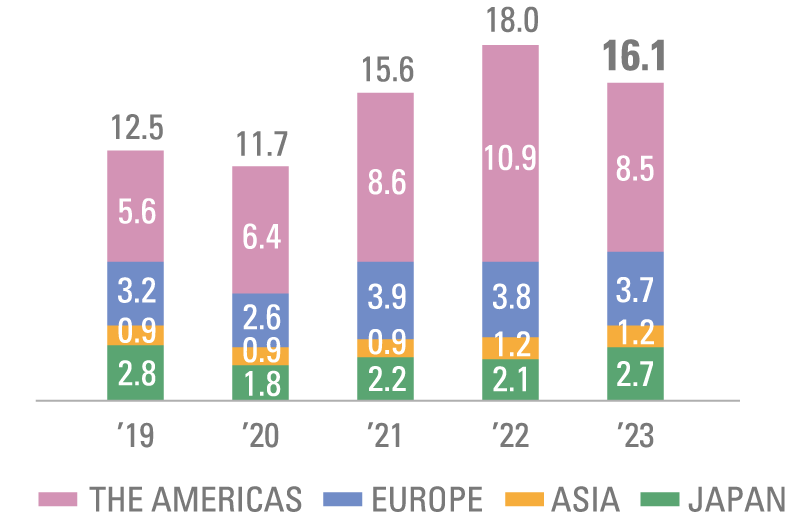

Turning to the Special Products Segment, sales of POS printers declined in 2023. This largely reflected the downturn in mPOS demand, which had remained robust. Looking at trends by geographic region, sales in the U.S. market decreased substantially. Despite the impact attributable to depreciation in the value of the yen, this decline in sales in the U.S. was mainly due to the downturn in mPOS demand. While market conditions were generally weak, sales in the European market were essentially unchanged from the previous year due to a variety of factors, including depreciation in the value of the yen. Turning to the Asian market, sales were for the most part also the same year on year. Meanwhile, despite weak market conditions throughout the domestic market, sales in Japan increased significantly compared with the previous year owing to the inclusion of SST in the Company’s scope of consolidation.

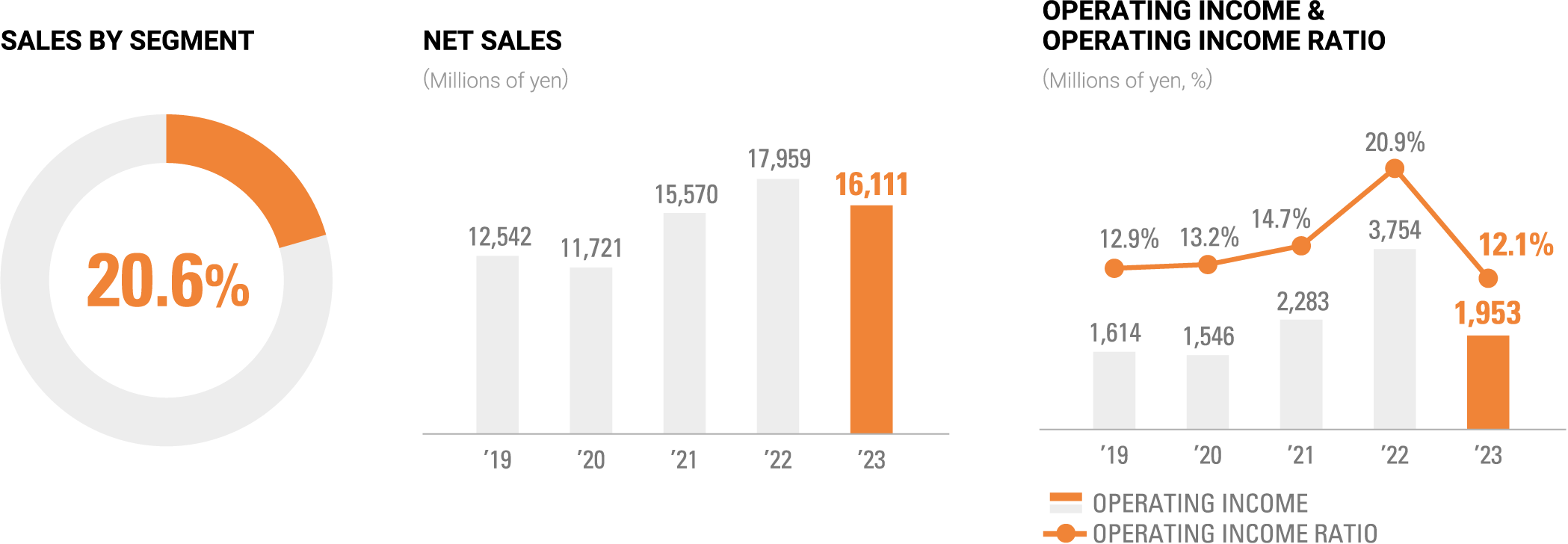

Accounting for each of the aforementioned factors, net sales in the Special Products Segment decreased 10.3% compared with the previous year, to ¥16,111 million (US$113,458 thousand). From a profit perspective, operating income fell 48.0% year on year, to ¥1,953 million (US$13,753 thousand).

SPECIAL PRODUCTS SEGMENT SALES

BY GEOGRAPHICAL REGION(Billions of yen)

Outlook for 2024 and Business Strategies

In 2024, overall sales in the Special Products Segment are projected to decline. Despite expectations of an upswing in sales attributable to new products and an increase in sales in Japan on the back of contributions from SST, this forecast downturn largely reflects the overall weak nature of market conditions especially in the U.S.

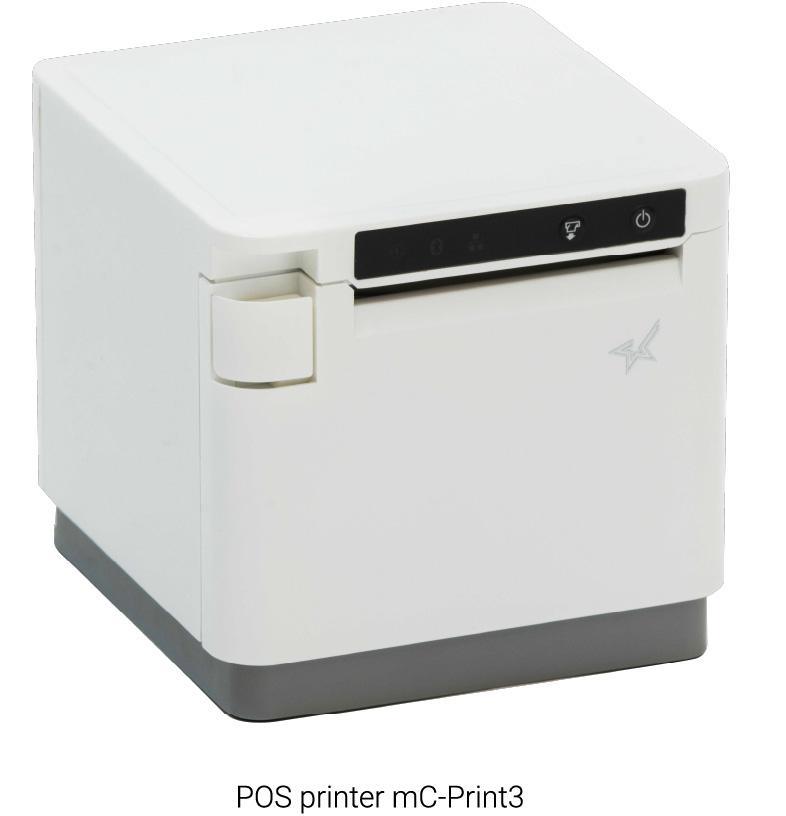

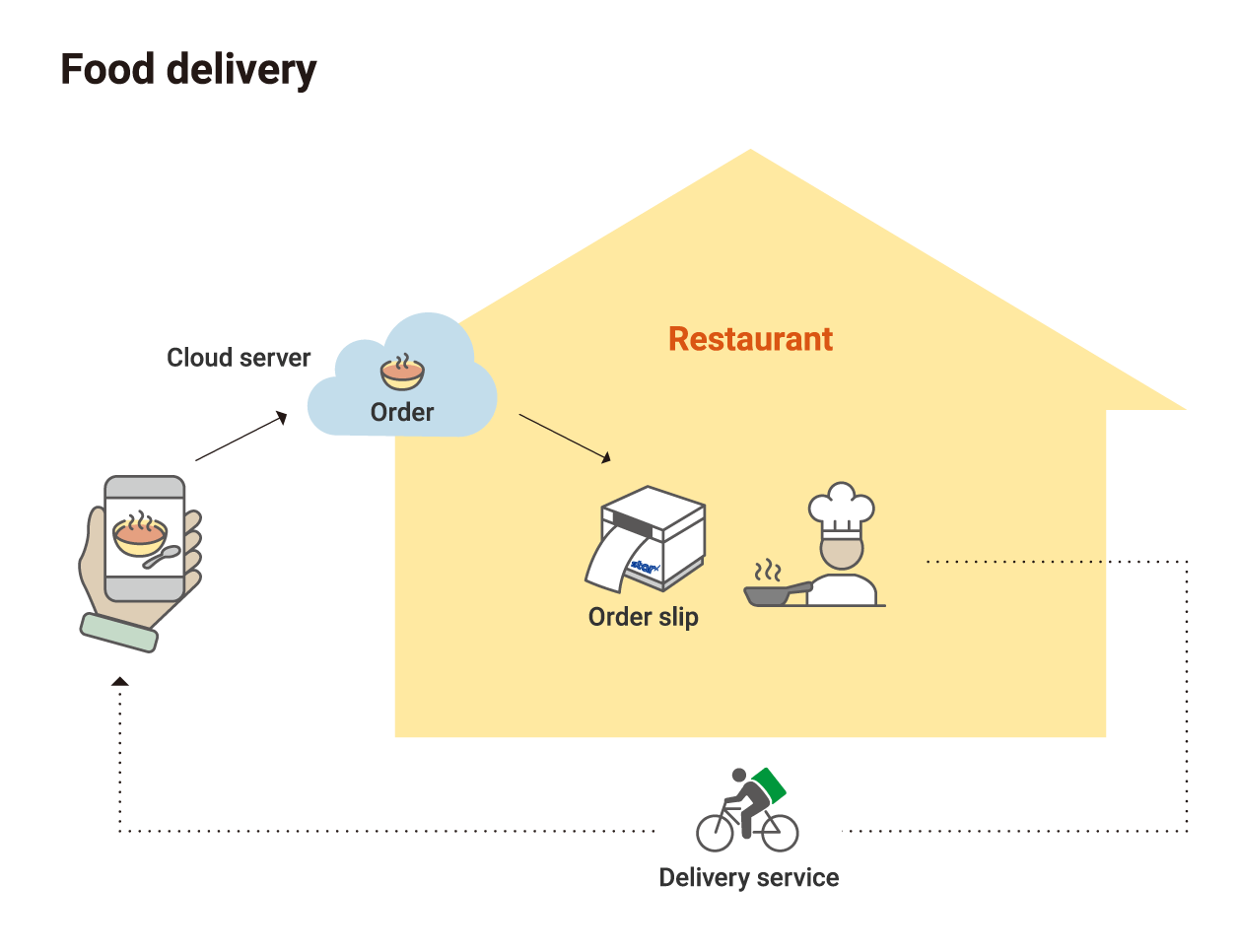

Star Micronics has positioned the mPOS and food delivery markets as areas on which to focus. As far as each of these markets are concerned, the Company released the TSP100IV SK, a linerless sticky label printer that supports repositionable labels, in November 2023 and a new model in the mC-Print®3 series of thermal mPOS printers in January 2024. Designed specifically for linerless sticky labels that can be easily removed and reapplied, the TSP100IV SK, addresses the label printing needs of restaurants and retail stores. Moving forward, Star Micronics will work to further increase its share in the expanding label printer market.

From a business results perspective, net sales are projected to come in at ¥14,870 million, down 7.7% compared with the current fiscal year. On the earnings front, operating income is forecast to decline 32.9% year on year, to ¥1,310 million.

| 2022 | 2023 | Change | |

|---|---|---|---|

| The Americas | 341 | 257 | -24.6% |

| Europe | 135 | 106 | -21.5% |

| Asia | 50 | 41 | -18.0% |

| Japan | 56 | 53 | -5.4% |

| Total | 583 | 459 | -21.3% |

Release of TSP100IV SK, a Linerless Sticky Label Printer

Star Micronics released a linerless sticky label printer that supports repositionable labels to meet the label needs of restaurants and retail stores in February 2024. Various types of labels are currently in use throughout today’s market. Linerless labels, in particular, are becoming increasingly popular owing to their convenience, reduced peeling time, and eco-friendly attributes that help eliminate excess waste. Turning to the types of linerless labels, sticky labels, which have weak adhesiveness, are distinguished by their removeable and re-appliable qualities. As such, sticky labels can be used in a variety of ways. This includes their temporary use as a slip for order cooking, which can then be attached to the delivery bag after cooking is completed. By responding to these needs through this product, we will work to further increase our share in the expanding label printer market.