Star Micronics ANNUAL REPORT 2022

STRATEGY

Medium-Term Management Plan

Star Micronics put in place a medium-term management plan in February 2022.

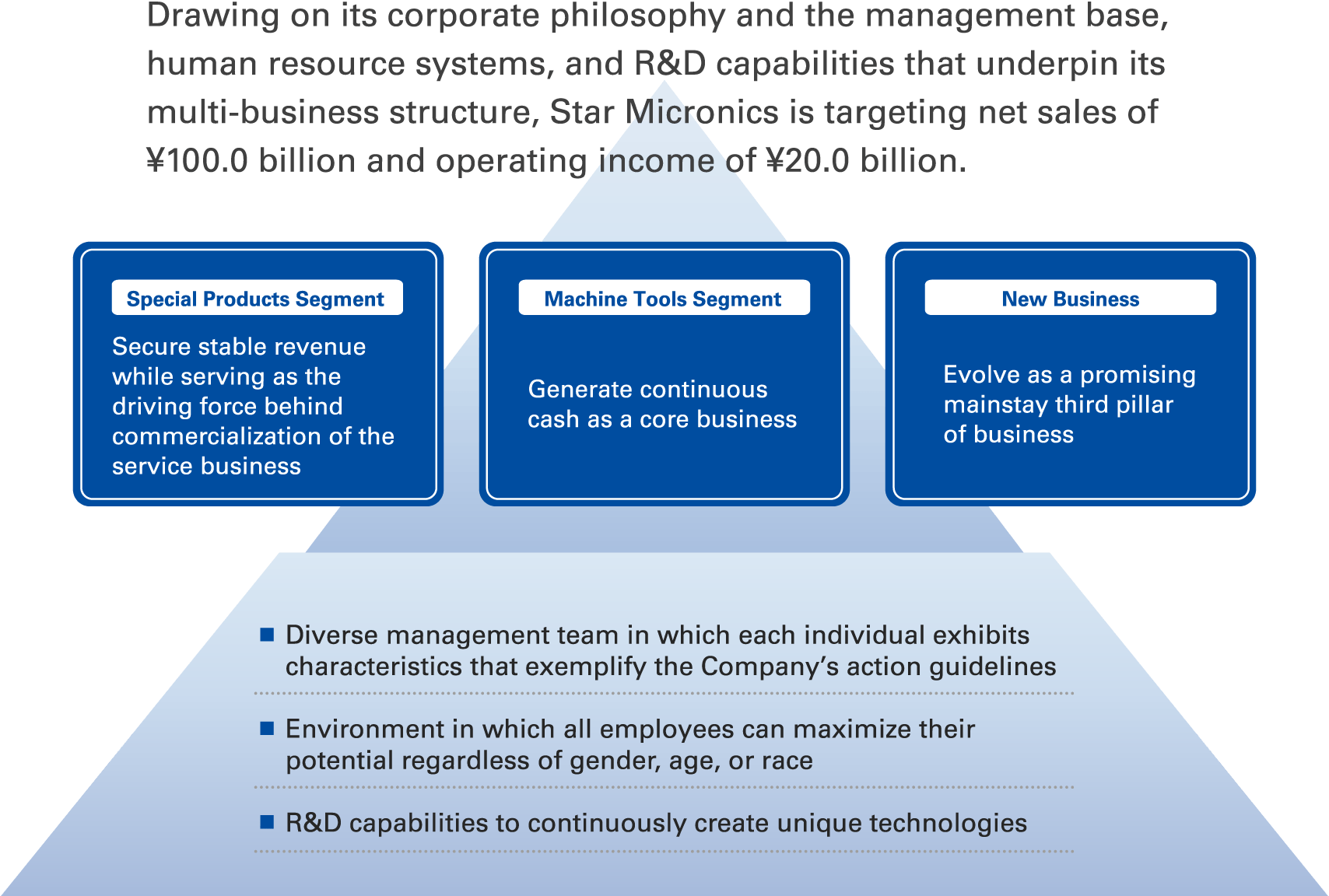

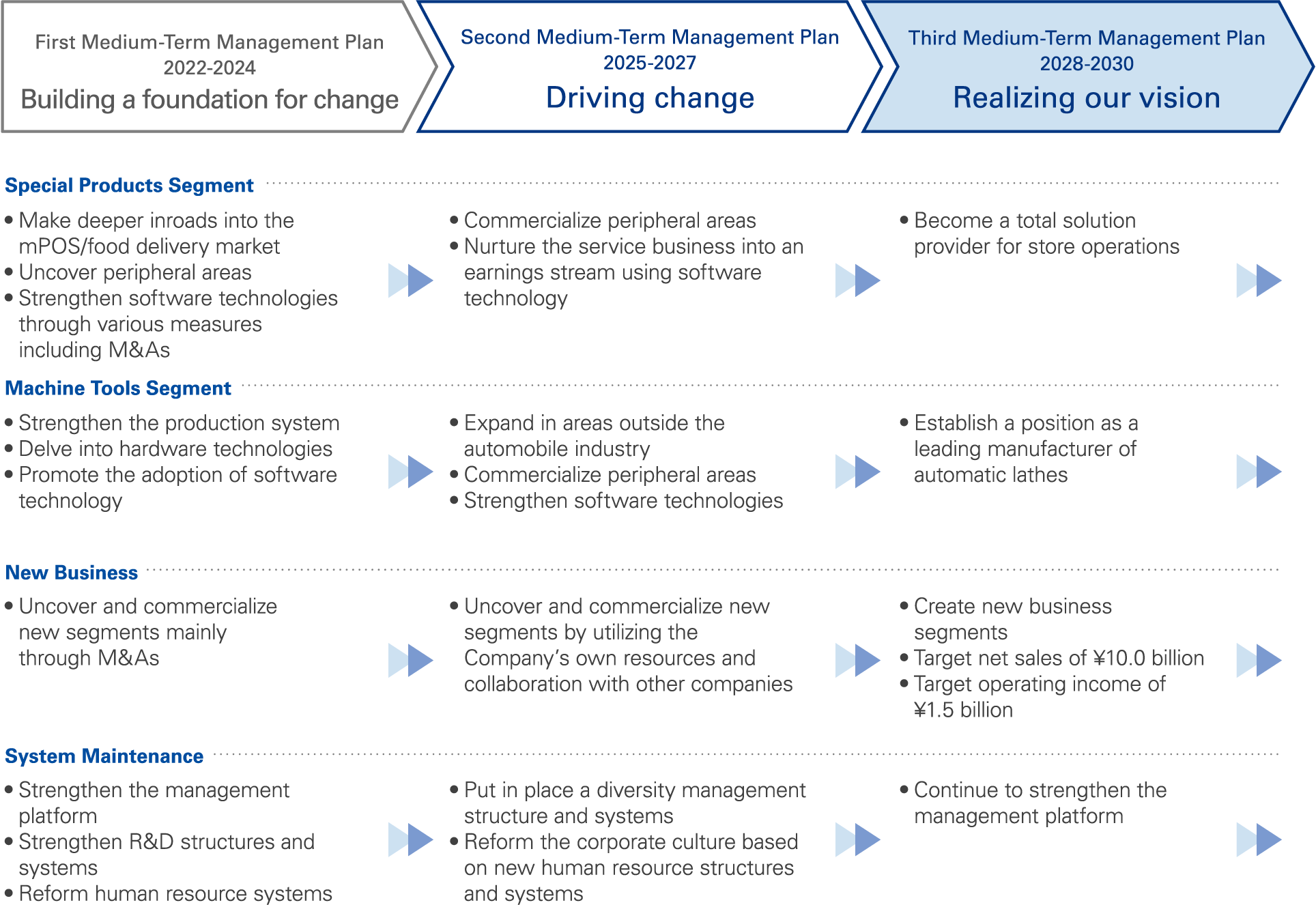

Taking stock of its Corporate Philosophy, Purpose, Management Policy, and Action Guidelines, the Company has outlined its Vision for 2030 based on the structure of this Philosophy and created a roadmap to realize this Vision.

Vision for 2030

Vision Roadmap

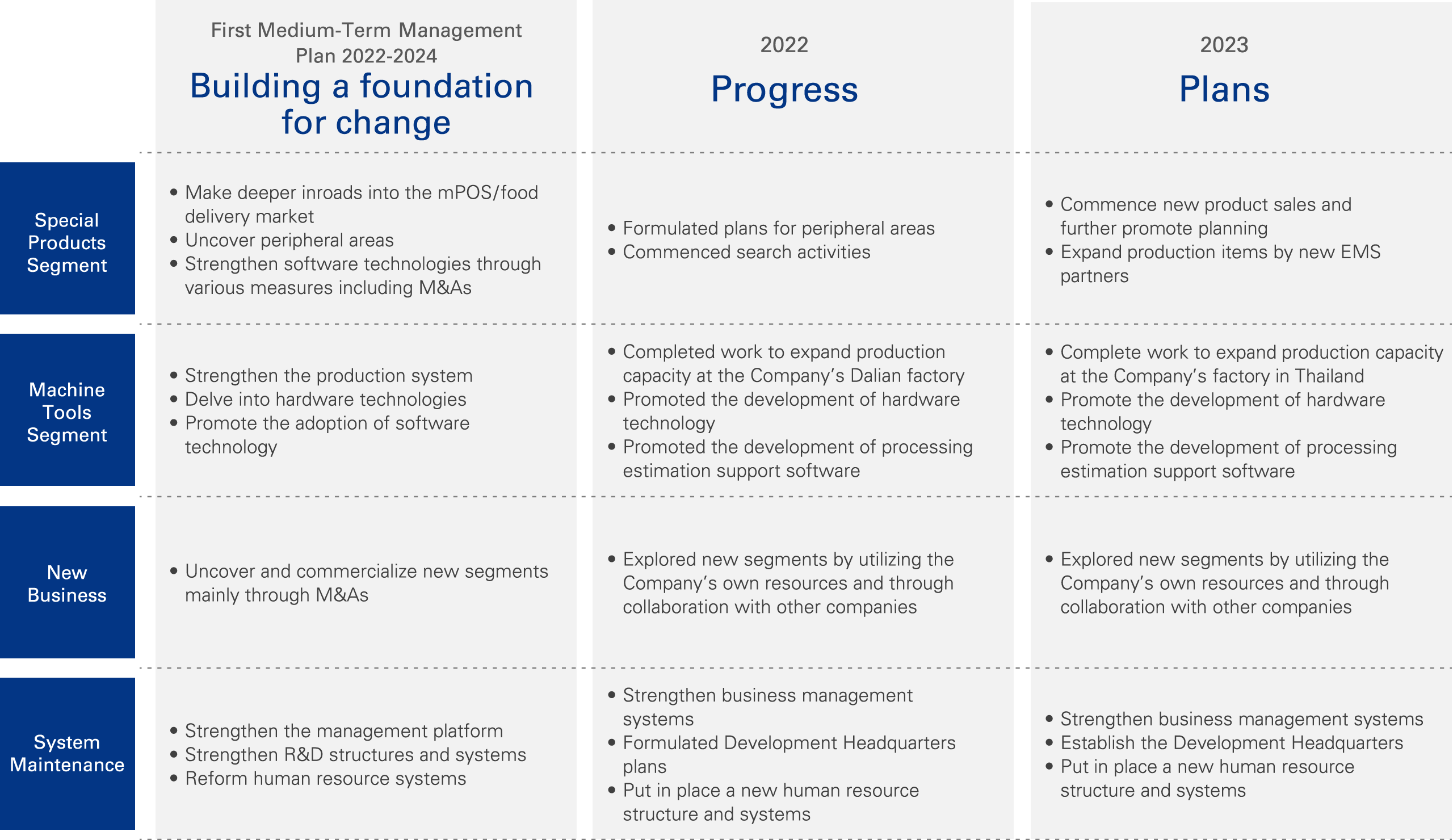

Progress of “Building a Foundation for Change”

In formulating the First Medium-Term Management Plan, Star Micronics has positioned the three years from 2022 to 2024 as a period for building a foundation for change in a bid to realize its Vision for 2030. Progress in 2022, the first year of the Medium-Term Management Plan, and plans for 2023 are presented as follows:

In addition, progress of each KPI is presented as follows:

| KPI | Target (Next three-year cumulative/average) |

2022 Actual | 2023 Forecast |

|---|---|---|---|

| Operating cash flow | ¥20.0 billion – ¥25.0 billion (cumulative) |

¥7.5 billion | ¥6.6 billion (cumulative ¥14.1 billion) |

| Operating income per employee (consolidated) | ¥6.00 million (average) |

¥8.37 million | ¥6.36 million |

| ROE | 10.0% or more (average) |

15.4% | 11.1% |

| Ratio of R&D expenses to net sales | 5.0% (average) |

2.3% | 2.5% |

| Education and training outlays per employee (non-consolidated) |

¥100,000* (average) |

¥89,084 | ¥86,782 |

* In order to further invest in human resources and enhance corporate value, the target of education and training outlays per employee has changed.

Business Strategy

[ Special Products Segment ]

First Medium-Term Management Plan 2022-2024 KPIs

| Target (Next three-year average) |

2022 Actual | 2023 Forecast | |

|---|---|---|---|

| ROA | 20.0% | 26.4% | 20.0% |

| Operating income ratio | 18.0% | 20.9% | 16.9% |

Principal Initiatives

- 1. Explore and expand sales of products other than printers used in stores

- 2. Strengthen cloud-related technologies with an eye to external alliances

- 3. Optimize production and logistics through reorganization of EMS partners

2022 Progress

- 1. Took preparatory steps to commence sales of peripheral equipment and began (initiated) further search activities

- 2. Undertook a renewal of the Star Micronics Cloud Service (SMCS) and bolstered development capabilities

- 3. Promoted the optimization of production and logistics through reorganization of EMS partners

2023 Plans

- 1. Commence sales of peripheral equipment and put in place additional plans for new products

- 2. Promote stable SMCS operations and bolster development capabilities

- 3. Expand production items by new EMS partners

[ Machine Tools Segment ]

First Medium-Term Management Plan 2022-2024 KPIs

| Target (Next three-year average) |

2022 Actual | 2023 Forecast | |

|---|---|---|---|

| ROA | 15.0% | 19.6% | 15.0% |

| Operating income ratio | 15.0% | 17.6% | 15.7% |

Principal Initiatives

- 1. Globally expand the Company’s Solution Center

Establish solution centers in Europe and Asia, building a user support system in collaboration with Japan - 2. Enhance the development of mechanical technology and before/after-sales service support software

- 3. Expand production capacity through three manufacturing bases

- (1) Undertake a large-scale renovation of domestic factories

- (2) Increase floor area at the Company’s Dalian factory

- (3) Upgrade and expand facilities and equipment at the Company’s factory in Thailand

2022 Progress

- 1. Took preparatory steps to commence operations at the Asia Solution Center

Formulated Europe Solution Center plans - 2. Promoted the development of mechanical technology and processing estimation support software; took preparatory steps to provide digital content

- 3. Expand production capacity through three manufacturing bases

- (1) Undertook a large-scale renovation of domestic factories (commenced the formulation of new factory plans; essentially in line with plans)

- (2) Increased floor area at the Company’s Dalian factory (completed in line with plans)

- (3) Upgraded and expanded facilities and equipment at the Company’s factory in Thailand (essentially in line with plans)

2023 Plans

- 1. Commence operations at the Asia Solution Center

Commence construction of Europe Solution Center - 2. Promote the development of mechanical technology and processing estimation support software; commence to provide digital content

- 3. Expand production capacity through three manufacturing bases

- (1) Undertake a large-scale renovation of domestic factories (commenced demolition work at certain existing factories)

- (2) Upgrade and expand facilities and equipment at the Company’s factory in Thailand (scheduled to be completed)

[ New Business ]

Create new business value that contributes to improve business efficiency of customers

Principal Initiatives Develop and commercialize new business proposals mainly through the use of M&A’s

Target 2024: Net sales of ¥3.0 billion, operating income of ¥0.3 billion

New Business Domains

| Business Domain | Value Provided/Business Process | 2022 Progress |

|---|---|---|

| Logistics DX | Provide systems to streamline the processes of small and medium-sized warehousing and distribution operations | Considered and put forward new business proposals, and approached potential business partners |

| Store DX | Provide hardware and software (systems) that streamline store operations | Promoted activities aimed at including Smart Solution Technology, Inc. (SST) in the Company’s scope of consolidation |

| Production DX | Provide new services related to the Machine Tools Segment | Promoted the development of processing estimation support software in cooperation with the Machine Tools Segment |

Cash Allocation

Drawing on its operating cash flow and cash on hand over the three years of the First Medium-Term Management Plan, Star Micronics will allocate ¥21 billion to growth investments as a part of efforts to carry out the aforementioned principal initiatives and ¥9 billion or more to address certain concerns including the return of profits to shareholders.

Fund Allocation Plan (2022–2024)

In putting in place and carrying out its shareholder return policy, Star Micronics is targeting a total payout ratio of 50% or more including the purchase of own shares based on a stable dividend of ¥60 or more per share.