Star Micronics ANNUAL REPORT 2022

SUSTAINABILITY CORPORATE GOVERNANCE

| Material issues | Targets |

|---|---|

|

|

| 2022 Progress |

|---|

|

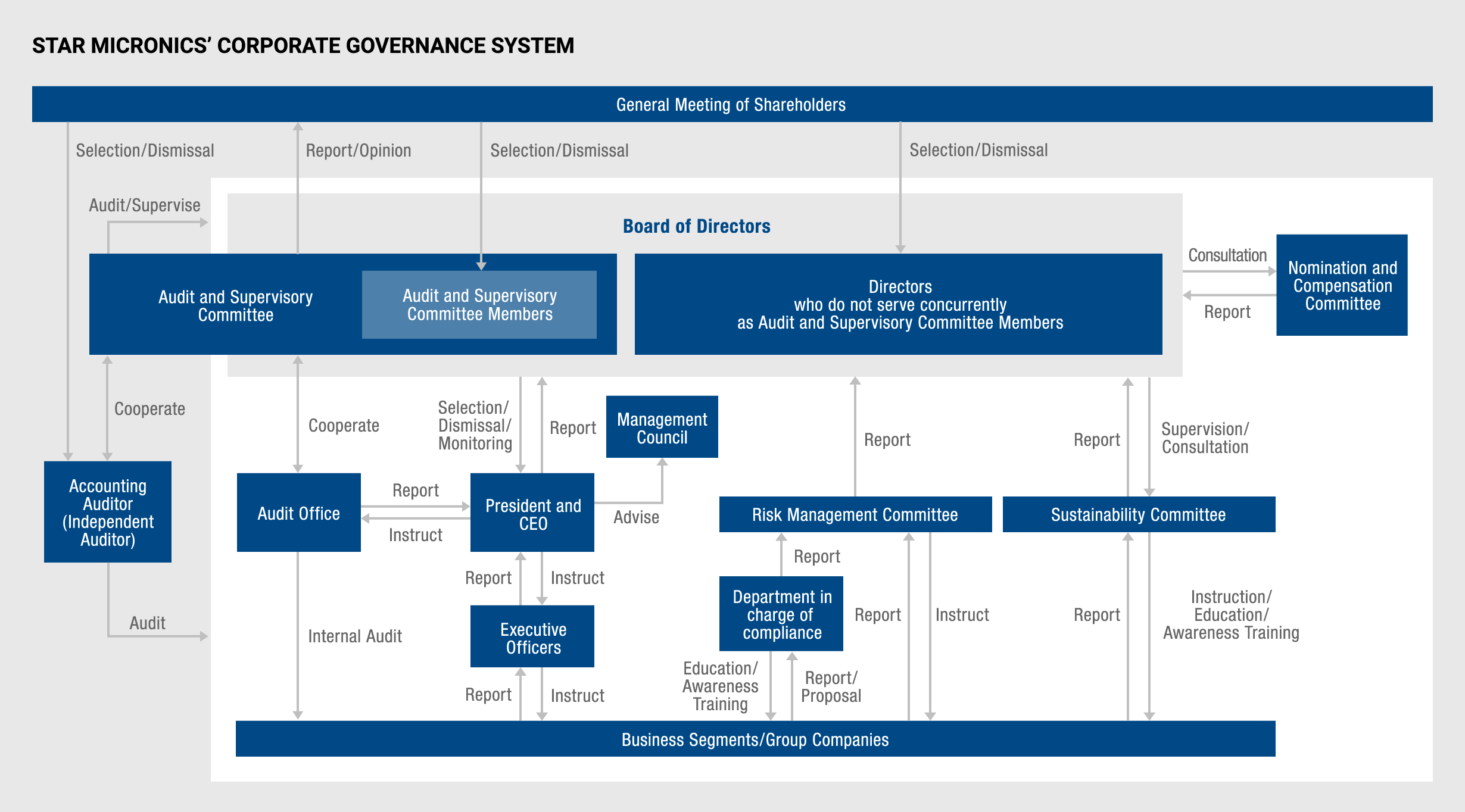

At Star Micronics, our basic approach to corporate governance is based on fulfilling our social responsibilities as a company. To this end, we strive to achieve appropriate and efficient management with a view to the sustained enhancement of corporate value and the realization of a sustained society, and to distribute the results of these efforts appropriately to shareholders and other stakeholders.

Star Micronics has adopted the structure of a company with an audit and supervisory committee in order to strengthen the supervisory function of its Board of Directors and to enhance its corporate governance capabilities.

Furthermore, an executive officer system was introduced to Star Micronics to speed up and raise the efficiency of business execution even further, and ensure that management as an organization is flexible and capable of prompt, rational decisions for executing business.

The Board of Directors is comprised of three Directors (one of whom is an independent Outside Director, excluding Directors who serve as Audit and Supervisory Committee Members) and three Directors who serve as Audit and Supervisory Committee Members (all of whom are independent Outside Directors), and is responsible for appropriate and efficient management decisions while supervising the execution of Directors’ duties from an independent standpoint.

The Audit and Supervisory Committee is comprised of three independent Outside Directors. In addition to auditing the activities of Directors in the general conduct of their duties, the Audit and Supervisory Committee is responsible for auditing the Company’s accounting statements and related documentation and preparing audit reports in accordance with audit policies and plans determined by the Audit and Supervisory Committee. Moreover, the Committee undertakes audits in conjunction with accounting auditors as well as internal audit and related departments.

On February 9, 2021, the Company established the Nomination and Compensation Committee as an arbitrary advisory body to the Board of Directors to increase the transparency and objectivity of procedures related to the nomination and compensation paid to Directors and Executive Officers. The Nomination and Compensation Committee is comprised of five Directors (four of whom are independent Outside Directors) appointed through a resolution of the Board of Directors. The Committee deliberates and reports on matters related to the selection, dismissal and compensation paid to Directors and Executive Officers in line with Board of Directors’ consultations.

Compensation of Directors and Audit and Supervisory Committee Members

Members of the Board of Directors at Star Micronics are compensated in accordance with the Company’s earnings performance. Their package consists of basic compensation that is paid monthly on a fixed basis, a yearly bonus as performance-based compensation and stock compensation provided as a medium- to long-term incentive. In view of the tasks that they are asked to perform, Directors who concurrently serve as Audit and Supervisory Committee Members and Outside Directors receive only the basic compensation.

The standard amount of basic compensation paid to Directors (excluding Directors who concurrently serve as Audit and Supervisory Committee Members) is determined by a resolution of the Board of Directors based on the Company’s performance as well as the status and position of each Director. Together with the bonus payment outlined below, the basic compensation paid to each Director shall not exceed ¥300 million annually. Of this total, the amount paid to Outside Directors shall not exceed ¥20 million annually.

The amount of basic compensation paid to each Director who concurrently serves as an Audit and Supervisory Committee Member shall not exceed ¥30 million annually and is determined through deliberations by the Audit and Supervisory Committee.

The total amount of bonuses paid to Directors is calculated by multiplying profit attributable to owners of the parent by a payment rate determined by the Company so as to function as an incentive to improve business performance. The amount of each bonus paid to individual Directors (excluding Directors who concurrently serve as Audit and Supervisory Committee Members and Outside Directors) shall be determined in line with the status and position of each Director based on the calculation method determined by the Board of Directors. After consulting with the Nomination and Compensation Committee, an arbitrary advisory body that is comprised of a majority of independent Outside Directors, and in line with the Committee’s report, the Company resolved that the payment of Directors’ bonuses fell within the scope of performance-based compensation stipulated under Article 34, Paragraph 1.3 of Japan’s Corporation Tax Act at a Board of Directors’ meeting held on March 23, 2023.

Turning to the matter of stock compensation, an amount is allocated in line with the status and position of each Director (excluding Directors who serve as Audit and Supervisory Committee Members as well as Outside Directors) as determined by a resolution of the Board of Directors. This amount shall comprise Ordinary Stock Options granted as a medium-term incentive and not exceed ¥20 million annually.

Meanwhile, in addition to granting incentives in a bid to improve the Company’s corporate value on a sustainable basis, Star Micronics allocates an amount of Restricted Stock that shall not exceed ¥80 million annually in line with the status and position of each Director (excluding Directors who serve as Audit and Supervisory Committee Members as well as Outside Directors) as determined by a resolution of the Board of Directors as a long-term incentive to further promote shared value with its shareholders.

| Director rank | Total compensation, etc. (¥ million) |

Total compensation by category (¥ million) |

Headcount of those eligible |

||||

|---|---|---|---|---|---|---|---|

| Fixed compensation |

Performance-based Compensation |

Stock Options |

Restricted Stock Compensation |

Non-monetary compensation, etc. in items on the left |

|||

| Directors (excluding Audit and Supervisory Committee Members) (excluding Outside Directors) |

221 | 123 | 54 | — | 44 | 44 | 3 |

| Directors (Audit and Supervisory Committee Members) (excluding Outside Directors) |

— | — | — | — | — | — | — |

| Outside Directors and Audit and Supervisory Committee Members |

25 | 25 | — | — | — | — | 5 |

- Notes:

-

- The figures for Restricted Stock Compensation and Performance-based Compensation are the monetary amounts recorded as expenses in the fiscal year under review.

- The aforementioned amount of Director compensation does not include salaries paid to Directors who are also employees of the Company.

- Star Micronics has paid ¥55 million in total to one Director of the Board upon their retirement. These payments are for severance of a retirement benefit allowance for Directors that was discontinued pursuant to a resolution of the Ordinary General Meeting of Shareholders for the 82nd Period held on May 24, 2007.

Internal Control System

Star Micronics strives to maintain an internal control system that will enable proper and efficient management to drive a continuous increase in corporate value. As far as its compliance structure and systems are concerned, in addition to formulating the Star Micronics Group Sustainability Code of Conduct, the Company is working to ensure thoroughgoing compliance through various measures. This includes putting in place rules and organizations. In addition, a department dedicated to corporate social responsibility (CSR) spearheads our compliance activities. This department plays a central role in providing reminders and education on compliance to the Group’s Directors, Executives and Employees, and is charged with holding periodic committee meetings and monitoring the status in regard to the Group’s adherence with all relevant laws and regulations. Star Micronics also has an appropriate internal control and whistleblower system for ensuring the reliability of its financial reporting, as stipulated in the Financial Instruments and Exchange Law of Japan.

Risk Management

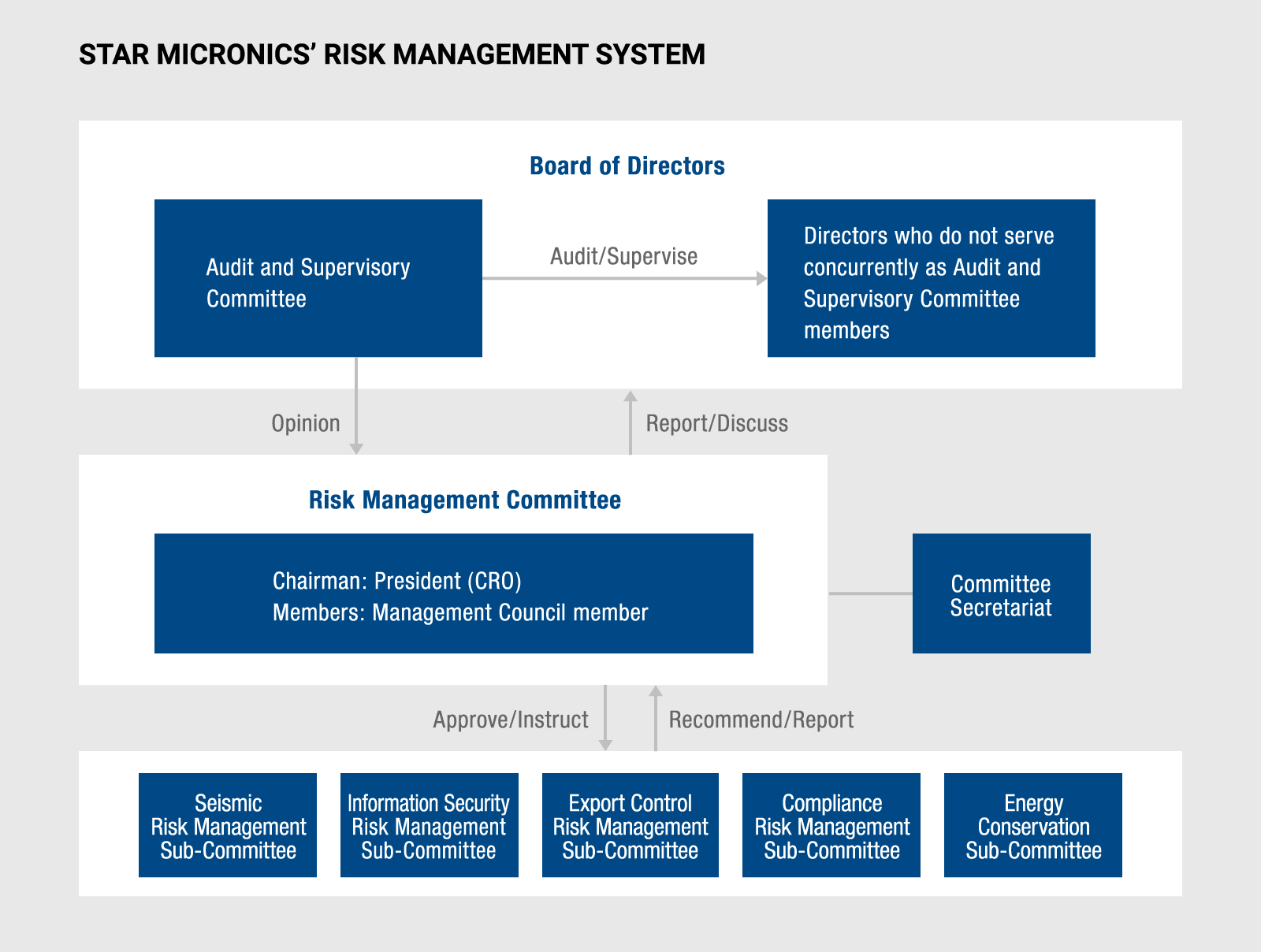

Star Micronics approaches the management of material risks such as legal issues, natural disasters, environmental considerations and export management in an organized and systematic manner. Departments and individuals are assigned as needed to manage a specific risk, and take responsibility for establishing rules and manuals, and so forth, for managing the risks. They also implement programs to alert, educate and prepare the Group’s Directors, Executives and Employees against the risks. There is also a committee which meets periodically to monitor and manage risks for the Group.