Star Micronics ANNUAL REPORT 2022

TO OUR SHAREHOLDERS

Confronting materiality to realize our purpose

Despite the ongoing uncertainty surrounding factors such as the prolonged impact of COVID-19 and global inflation, both the Machine Tools and Special Products segments performed well in 2022, achieving record highs in net sales as well as net income attributable to owners of the parent.

2023 is the second year of our First Medium-Term Management Plan, a roadmap for building a foundation for change over the three-year period from 2022 to 2024. Recognizing the need to further solidify our foundation, we will redouble efforts to bring about a sustainable society and enhance corporate value by putting into practice our corporate philosophy of the Company and employees growing together and contributing to society.

Mamoru Sato

Representative Director,

President and CEO

INDEX

01Operating Results in 2022

Looking at 2022, global economic conditions remained uncertain. In addition to the effects of COVID-19, this uncertainty was due to a variety of factors including the accelerated pace of global inflation, soaring resource prices triggered by the prolonged Ukraine crisis, tight supply of components and parts such as semiconductors, and sharp fluctuations in foreign currency exchange rates. By geographic region, the U.S. economy exhibited a recovery trend on the back of steady consumer spending. In contrast, economic conditions throughout Europe were generally weak. In Asia, China’s economy remained firm despite significant restrictions on economic activities owing to the government’s decision to adopt a zero-corona policy. On the domestic front, Japan witnessed a modest economic recovery.

In each of the major markets in which the Star Micronics Group operates, demand for POS printers was strong especially in the U.S. At the same time, overseas demand for the Group’s mainstay machine tools remained generally high with firm demand also in Japan.

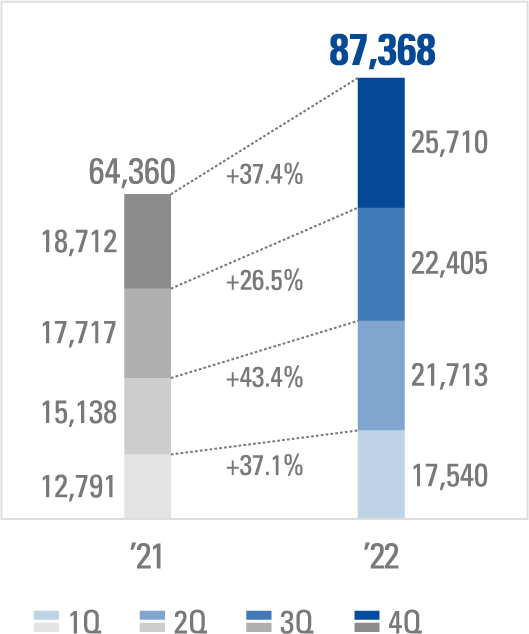

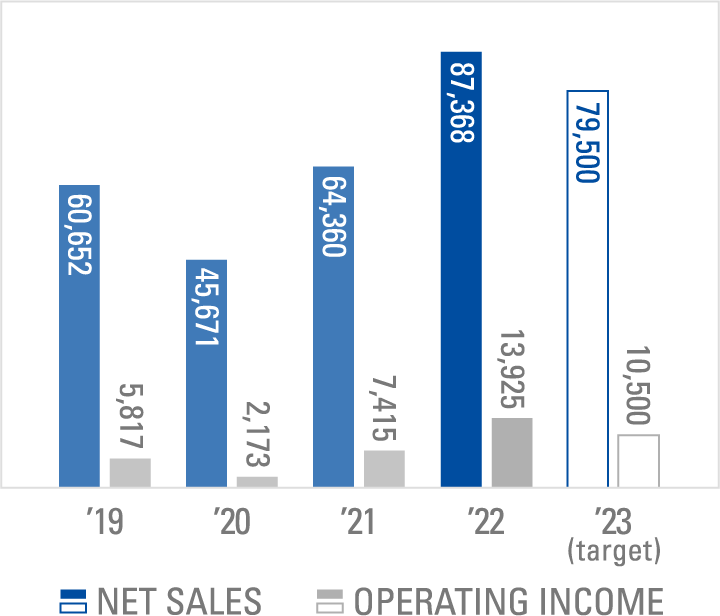

Under these circumstances, the Star Micronics Group reported net sales of ¥87,368 million for 2022, up 35.7% compared with the previous year. This was largely due to the substantial increase in sales of machine tools. From a profit perspective, operating income climbed 87.8%, to ¥13,925 million owing mainly to the substantial jump in sales. Net income attributable to owners of the parent amounted to ¥10,299 million, up 79.4% year on year.

NET SALES(Millions of yen, %)

02Business Overview

In the Machine Tools Segment, sales of CNC automatic lathes jumped significantly amid brisk global demand for capital investment. By geographic region, sales were strong across a wide range of industries centered on the medical-related sector in the U.S. market. In the European market, sales were robust mainly in automotive-related industries. Accordingly, sales rose significantly in each market. Despite signs of a cautious approach toward capital investment in China over the latter half of the year, sales in the Asian market increased. This was mainly due to the ongoing high level of sales mainly in automotive-related industries. With signs of a recovery across a wide range of industries, sales in the domestic market increased substantially. This was despite the delay in the automotive-related recovery in Japan.

As a result of each of the aforementioned factors, both sales and profits increased substantially. In specific terms, sales grew 42.3% compared with the previous year to ¥69,409 million. Operating income jumped 78.6% year on year to ¥12,249 million.

Turning to the Special Products Segment, despite the impact of factors such as delays in the supply of products attributable to shortages in the procurement of components and parts as well as disruptions to logistics, sales of POS printers increased. In addition to the ongoing period of favorable market conditions, which reflected continued brisk mPOS demand in each market, this increase in sales was largely due to the impact of the yen’s depreciation. Looking at trends by geographic region, sales in the U.S. market increased substantially. While delays in the supply of products had a negative effect, this was largely attributable to the impact of the yen’s depreciation. In the European and domestic markets, conditions were favorable; however, European and domestic sales decreased due to delays in the supply of products.

As a result, both sales and profits grew. In specific terms, sales increased 15.3% compared with the previous year, to ¥17,959 million. Operating income grew substantially climbing 64.5% year on year, to ¥3,754 million.

03Outlook for the Following Year

Looking ahead, conditions throughout the global economy are expected to remain uncertain. In addition to ongoing concerns surrounding geopolitical risks where no end is in sight, including the crisis in Ukraine, there are anxieties toward the economic slowdown caused by inflation and trends in energy prices which continue to over at a high level. In Japan, the impact of volatile foreign currency exchange rates also continues to be a major cause for concern.

Under these circumstances, and in the context of the Company’s consolidated business performance for the coming year, sales in the mainstay Machine Tools Segment are forecast to decline. Despite expectations of an upswing in sales as order backlogs clear in Europe and the U.S., this forecast decline is due to concerns surrounding a downturn in capital investment demand triggered by the slowdown in economic conditions. In the Special Products Segment, sales are projected to stall in the U.S., but remain firm in the European market. Taking into account these and other factors including the impact of foreign currency exchange rates, sales in this segment are forecast to remain at the same level as the year under review.

Taking into account the aforementioned factors, we are projecting a downturn in consolidated results in the coming year. In specific terms, we expect a decrease in net sales of 9.0% compared with 2022, to ¥79,500 million. On a year-on-year basis, operating income is forecast to decline 24.6%, to ¥10,500 million and net income attributable to owners of the parent to also drop 21.3%, to ¥8,100 million.

Forecasts are based on the assumptions that the yen/U.S. dollar exchange rate will be ¥125 and the yen/Euro exchange rate will be ¥130.

NET SALES AND

OPERATING INCOME(Millions of yen)

04About the Medium-Term Management Plan

The Star Micronics Group formulated its Medium-Term Management Plan as part of a review of its Corporate Philosophy, Purpose, Management Policy, and Action Guidelines to empower employees to make decisions and act autonomously as we seek to become a company that grows sustainably together with society. At the same time, we formulated a Vision for 2030. (Please refer to the Company’s Medium-Term Management Plan for details.)

In order to realize its Vision for 2030, the Company has divided the next nine years into three-year periods. In working toward “building a foundation for change,” “driving change,” and “realizing our vision” over each period, respectively, Star Micronics has formulated the first Medium-Term Management Plan covering the three years from 2022 to 2024.

Positioning the mPOS and food delivery markets as a principal area of operations, the Star Micronics Group will work to further expand sales of printers and peripheral equipment while at the same time refining software technologies in a bid to continue providing new value to customers. Through these means, the Group will endeavor to become a total solution provider for store operations in the Specialty Products Segment.

In the Machine Tools Segment, the Group will strengthen the production system in Thailand and China, position the Kikugawa Factory as a sustainable factory that nurtures people, develops technology, and grows together with society and promote large-scale renovation in order to meet robust demand for facilities and equipment. At the same time, steps will be taken to delve deeper into hardware technologies and adopt software technologies, and to further cement the Group’s position as a leading manufacturer of automatic lathes.

As far as new business is concerned, the Group will focus on uncovering opportunities in the three production DX, store DX, and logistics DX domains while aiming to construct a new business model mainly through M&As.

From a Group-wide perspective, energies will be directed toward strengthening the management platform, reforming human resource systems that allow employees to maximize their potential, and constructing R&D structures and systems to continuously create proprietary technologies, while vigorously moving forward with initiatives to address material issues based on the Sustainability Policy.

Positioned as KPIs, we are targeting cumulative operating cash flow of ¥20-¥25 billion, an average consolidated annual operating income per employee of ¥6 million, ROE of 10.0% or more, a ratio of R&D expenses to net sales of 5.0%, and non-consolidated annual education and training outlays per employee of ¥100,000 over the three-year period from 2022 to 2024. In the first year, 2022, operating cash flow, consolidated annual operating income per employee, ROE, the ratio of R&D expenses to net sales, and non-consolidated annual education and training outlays per employee came in at ¥7.5 billion, ¥8.37 million, 15.4%, 2.3%, and ¥89,084, respectively.

We will continue to aggressively reform our business and management on an ongoing basis and make concerted Group-wide efforts to enhance our corporate value.

05Corporate Governance and Shareholder Returns

The Board of Directors of the Company consists of two internal directors and four outside directors, and thus the outside directors already account for the majority. Star Micronics has also put in place the non-mandatory Nomination and Compensation Committee as an advisory body to the Board of Directors to enhance the transparency and objectivity of procedures related to the nomination and compensation of directors and executive officers and to further enhance corporate governance.

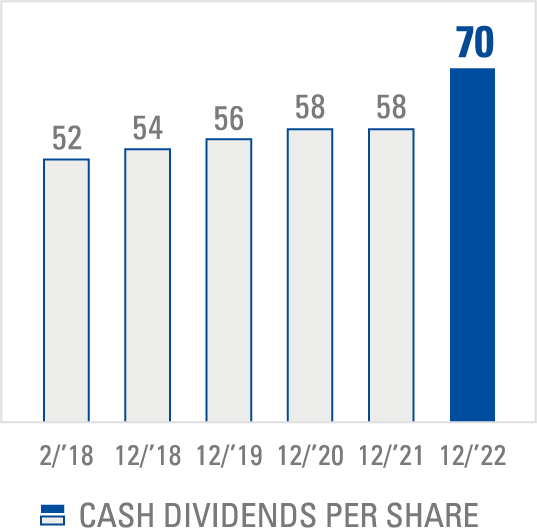

Star Micronics positions the return and distribution of profits to shareholders as an important management priority. Under its shareholder return policy, the Company has decided to target a consolidated total payout ratio of at least 50%, including the repurchase of its own shares, with the aim of paying a stable annual dividend of at least ¥60 per share.

Taking into consideration its consolidated business performance for the year under review and the Company’s record high net sales and net income attributable to owners of the parent, Star Micronics recognizes the critical need to further upgrade and expand the return and distribution of profits to shareholders including dividends. As far as its year-end dividend is concerned, the Company has therefore decided to pay a period-end dividend of ¥40 per share, comprising an ordinary dividend of ¥30 per share and a special dividend of ¥10 per share. Together with the interim dividend of ¥30 per share, the Company has decided to pay a record-high annual dividend of ¥70 per share.

As far as the Company’s internal reserves are concerned, Star Micronics is committed to enhancing its corporate value while increasing shareholders’ profits. At the same time, the Company will look to engage in a variety of activities including investment in future growth fields in a bid to ensure its sustainable growth.

Looking ahead, Star Micronics plans to page an interim and period-end dividend of ¥30 per share for an annual dividend of ¥60 per share for 2023.

In working toward achieving its established goals, the Star Micronics Group kindly requests the continued support and understanding of all stakeholders.

March 2023

Mamoru Sato

Representative Director, President and CEO

CASH DIVIDENDS

PER SHARE(Yen)